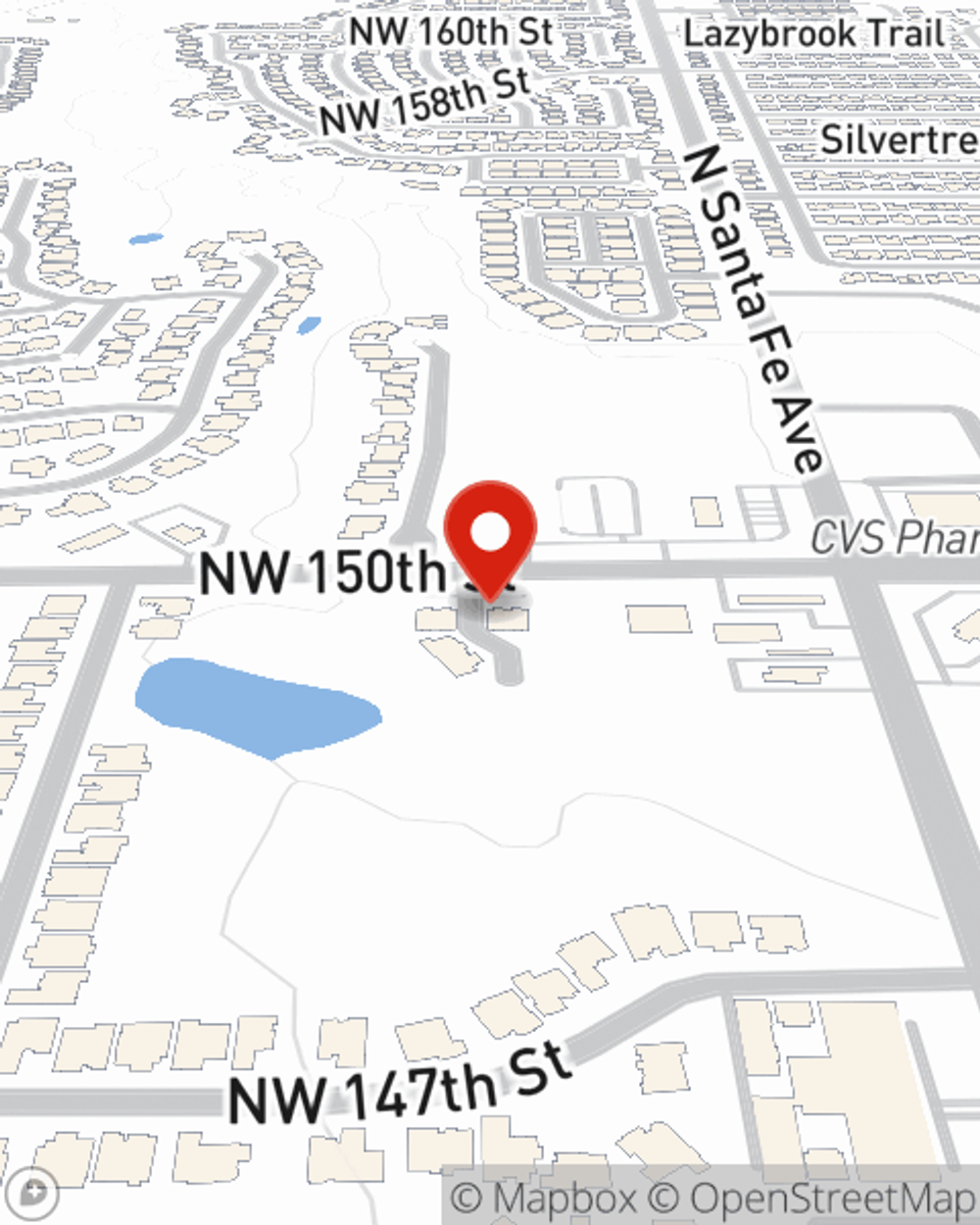

Business Insurance in and around Edmond

Looking for small business insurance coverage?

This small business insurance is not risky

- Piedmont, Oklahoma

- Edmond, Oklahoma

- Yukon, Oklahoma

- Oklahoma City, OK

- Canadian County

- Oklahoma County

- Mustang, Oklahoma

- Tuttle, Oklahoma

- Kingfisher, Oklahoma

- Bethany, Oklahoma

- Nichols Hills, OK

- Spencer, Oklahoma

- Moore, OK

- Norman, OK

- Stillwater, OK

- El Reno, OK

- Perkins, OK

- Serving Texas

- Serving Kansas

- Serving Arkansas

- Serving Oklahoma

State Farm Understands Small Businesses.

Do you feel like there's so much to think about when it comes to owning your small business? It can be a lot to manage! Let State Farm agent Ann Smith help you learn about excellent business insurance.

Looking for small business insurance coverage?

This small business insurance is not risky

Small Business Insurance You Can Count On

That's because a small business policy from State Farm covers a wide range of concerns. Your coverage can include a business owners policy that provides for loss of income (for up to 12 months) in the event your business is closed down. It not only protects your pay, but also helps with regular payroll costs. You can also include liability, which is important coverage protecting your financial assets in the event of a claim or judgment against you by a customer.

It's time to visit State Farm agent Ann Smith. You'll quickly perceive why State Farm is one of the leading providers of small business insurance.

Simple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.

Ann Smith

State Farm® Insurance AgentSimple Insights®

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

What are typical landlord maintenance responsibilities?

What are typical landlord maintenance responsibilities?

As a landlord, there are certain maintenance responsibilities associated with the property. Equip yourself to better address repairs while minimizing preventable issues.